Key Takeaways

- Med A audits help long-term care facilities identify and eliminate revenue leakage.

- Audits enhance billing accuracy, leading to fewer claim denials and faster reimbursements.

- Regular audits ensure compliance with Medicare regulations, avoiding costly penalties.

- Training staff in accurate documentation reduces errors and optimizes revenue.

- Utilizing data analytics from audits supports better decision-making and operational efficiency.

Revenue Cycle Management: How Med A Audits Helps Long-Term Care Facilities Optimize Revenue

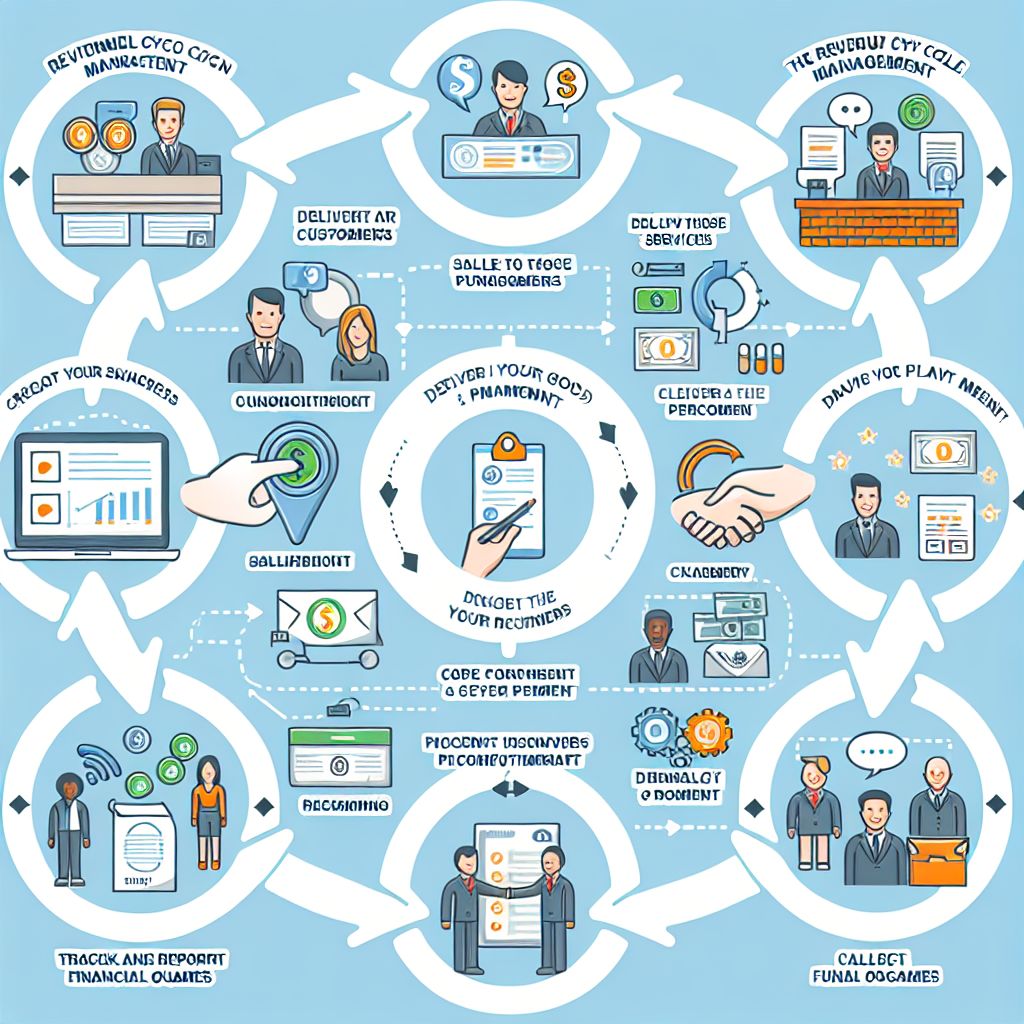

Starting with Effective Revenue Cycle Management

Revenue cycle management (RCM) is crucial for any healthcare facility, especially long-term care facilities. It encompasses the entire financial process from a patient’s initial appointment to the final payment. The goal is to ensure that healthcare providers are paid accurately and promptly for their services.

To start, it’s essential to understand the key components of RCM:

- Patient Registration

- Insurance Verification

- Charge Capture

- Claim Submission

- Payment Posting

- Denial Management

- Patient Collections

Each of these steps must be executed flawlessly to optimize revenue. Any hiccup along the way can result in delayed or denied payments.

The Importance of Revenue Cycle Management in Long-Term Care Facilities

Long-term care facilities face unique challenges in revenue cycle management. They deal with a high volume of patients, many of whom require extensive and continuous care. This makes accurate documentation and billing even more critical.

Effective RCM ensures a steady cash flow, which is vital for maintaining the quality of care. It also reduces administrative burdens and allows healthcare providers to focus more on patient care rather than financial issues.

Most importantly, efficient RCM can significantly reduce the number of denied claims. Denied claims not only delay payments but also require additional resources to appeal and correct, which can be costly. Learn more about accurate billing for long-term care facilities.

How Audits Enhance Revenue Optimization

The Role of Audits in Identifying Revenue Leakage

Audits play a crucial role in identifying revenue leakage in long-term care facilities. Revenue leakage occurs when potential revenue is lost due to errors, inefficiencies, or non-compliance with regulations. For more insights, explore how accurate billing for long-term care facilities can prevent such issues.

Med A audits focus specifically on Medicare Part A claims, which cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. These audits help identify areas where the facility may be losing money due to incorrect billing or coding errors.

Common Errors and How Audits Detect Them

Common errors that Med A audits can detect include:

- Incorrect coding of diagnoses and procedures

- Inaccurate patient information

- Duplicate billing

- Services not documented

- Non-compliance with Medicare guidelines

By identifying these errors, audits help facilities correct them before they result in denied claims or lost revenue. For example, if an audit reveals that a facility is frequently billing for services not documented, the facility can implement stricter documentation protocols to prevent future errors.

Advantages of Implementing Med A Audits

Streamlining Billing Processes

One of the primary advantages of Med A audits is that they help streamline billing processes. By identifying and correcting errors, audits ensure that claims are accurate and complete before submission. This reduces the likelihood of denials and speeds up the reimbursement process.

Ensuring Compliance with Medicare Regulations

Medicare regulations are complex and constantly changing. Non-compliance can result in denied claims, penalties, and even legal action. Med A audits help ensure that facilities are in compliance with all Medicare regulations, reducing the risk of costly penalties.

Streamlining Billing Processes

Med A audits are essential for streamlining billing processes in long-term care facilities. By thoroughly examining billing records and procedures, these audits can pinpoint inefficiencies and errors. For instance, if a facility is consistently submitting claims with incorrect codes, an audit will highlight this issue, allowing the facility to retrain staff and correct the problem. This leads to more accurate billing, faster reimbursements, and a significant reduction in administrative burdens.

Moreover, audits can reveal patterns of recurring errors, enabling facilities to address systemic issues rather than just individual mistakes. This proactive approach ensures that billing processes are continually improving, leading to optimized revenue cycles.

Ensuring Compliance with Medicare Regulations

Medicare regulations are stringent and subject to frequent updates. Non-compliance can result in severe financial penalties and even jeopardize a facility’s ability to operate. Med A audits help long-term care facilities stay compliant by ensuring that all billing practices adhere to current Medicare guidelines.

During an audit, all aspects of billing are scrutinized, from the accuracy of patient information to the correct application of Medicare codes. This thorough review ensures that facilities are not only compliant but also prepared for any regulatory changes that may arise. For more insights on how audits can help, check out our article on the importance of accurate audit services.

Reducing Claim Denials and Delays

Claim denials and delays are major issues that can severely impact a facility’s cash flow. Med A audits are instrumental in reducing these problems by identifying and correcting errors before claims are submitted. This proactive approach minimizes the risk of denials and ensures that payments are received promptly.

For example, if an audit reveals that a significant number of claims are being denied due to insufficient documentation, the facility can take immediate steps to improve its documentation practices. This not only reduces the number of denied claims but also speeds up the overall reimbursement process.

Improving Operational Efficiency with Med A Audits

Besides optimizing revenue, Med A audits also play a crucial role in enhancing the overall operational efficiency of long-term care facilities. By identifying inefficiencies and areas for improvement, audits help facilities streamline their processes and make better use of their resources.

Operational efficiency is not just about cutting costs; it’s about ensuring that every aspect of the facility’s operations is running smoothly and effectively. This includes everything from patient care to administrative tasks.

“By conducting regular Med A audits, we were able to identify several inefficiencies in our billing process. This allowed us to retrain our staff and implement new procedures that significantly reduced our claim denial rates.” – Facility Administrator

Let’s explore some specific ways in which Med A audits can improve operational efficiency:

Training Staff for Accurate Documentation

Accurate documentation is critical for successful billing and compliance. Med A audits can identify areas where staff may need additional training. For example, if an audit reveals that documentation errors are leading to claim denials, the facility can provide targeted training to address these issues.

Regular training sessions ensure that staff are up-to-date with the latest documentation requirements and best practices. This not only reduces errors but also improves the overall quality of patient care.

Utilizing Data Analytics for Better Decision-Making

Data analytics is a powerful tool that can provide valuable insights into a facility’s operations. Med A audits generate a wealth of data that can be analyzed to identify trends, patterns, and areas for improvement. Learn more about revenue cycle management and how it can optimize your facility’s performance.

For instance, if data analysis reveals that a particular type of claim is frequently denied, the facility can investigate the underlying causes and take corrective action. This data-driven approach supports better decision-making and helps facilities optimize their revenue cycles.

Enhancing Patient Experience and Satisfaction

While the primary focus of Med A audits is on financial and operational efficiency, they also have a positive impact on patient experience and satisfaction. By ensuring accurate billing and reducing claim denials, audits help to minimize the financial stress on patients and their families.

Moreover, efficient operations and accurate documentation contribute to higher quality care, which directly impacts patient satisfaction. When facilities are running smoothly, staff can focus more on providing excellent care, leading to better outcomes for patients.

Case Studies: Success Stories of Revenue Optimization

To illustrate the impact of Med A audits on revenue optimization, let’s look at some real-world examples of facilities that have successfully implemented these audits.

- Example 1: Increasing Collections through Accurate Billing

- Example 2: Reducing Denial Rates by 20%

- Example 3: Streamlining Operations for Improved Efficiency

These case studies demonstrate the tangible benefits of Med A audits and provide valuable insights into how other facilities can achieve similar results.

Example 1: Increasing Collections through Accurate Billing

A long-term care facility was struggling with low collection rates due to frequent billing errors. They decided to implement regular Med A audits to identify and correct these errors.

During the first audit, they discovered that a significant number of claims were being denied due to incorrect coding. By retraining their billing staff and implementing new procedures, they were able to reduce these errors and increase their collection rates by 30% within six months.

Med A audits are essential for streamlining billing processes in long-term care facilities. By thoroughly examining billing records and procedures, these audits can pinpoint inefficiencies and errors. For instance, if a facility is consistently submitting claims with incorrect codes, an audit will highlight this issue, allowing the facility to retrain staff and correct the problem. This leads to more accurate billing, faster reimbursements, and a significant reduction in administrative burdens.

Moreover, audits can reveal patterns of recurring errors, enabling facilities to address systemic issues rather than just individual mistakes. This proactive approach ensures that billing processes are continually improving, leading to optimized revenue cycles.

Ensuring Compliance with Medicare Regulations

Medicare regulations are stringent and subject to frequent updates. Non-compliance can result in severe financial penalties and even jeopardize a facility’s ability to operate. Med A audits help long-term care facilities stay compliant by ensuring that all billing practices adhere to current Medicare guidelines.

During an audit, all aspects of billing are scrutinized, from the accuracy of patient information to the correct application of Medicare codes. This thorough review ensures that facilities are not only compliant but also prepared for any regulatory changes that may arise.

Reducing Claim Denials and Delays

Claim denials and delays are major issues that can severely impact a facility’s cash flow. Med A audits are instrumental in reducing these problems by identifying and correcting errors before claims are submitted. This proactive approach minimizes the risk of denials and ensures that payments are received promptly.

For example, if an audit reveals that a significant number of claims are being denied due to insufficient documentation, the facility can take immediate steps to improve its documentation practices. This not only reduces the number of denied claims but also speeds up the overall reimbursement process.

Improving Operational Efficiency with Med A Audits

Besides optimizing revenue, Med A audits also play a crucial role in enhancing the overall operational efficiency of long-term care facilities. By identifying inefficiencies and areas for improvement, audits help facilities streamline their processes and make better use of their resources.

Operational efficiency is not just about cutting costs; it’s about ensuring that every aspect of the facility’s operations is running smoothly and effectively. This includes everything from patient care to administrative tasks. For instance, accurate billing is crucial for maintaining financial stability in long-term care facilities.

“By conducting regular Med A audits, we were able to identify several inefficiencies in our billing process. This allowed us to retrain our staff and implement new procedures that significantly reduced our claim denial rates.” – Facility Administrator

Let’s explore some specific ways in which Med A audits can improve operational efficiency:

Training Staff for Accurate Documentation

Accurate documentation is critical for successful billing and compliance. Med A audits can identify areas where staff may need additional training. For example, if an audit reveals that documentation errors are leading to claim denials, the facility can provide targeted training to address these issues.

Regular training sessions ensure that staff are up-to-date with the latest documentation requirements and best practices. This not only reduces errors but also improves the overall quality of patient care.

Utilizing Data Analytics for Better Decision-Making

Data analytics is a powerful tool that can provide valuable insights into a facility’s operations. Med A audits generate a wealth of data that can be analyzed to identify trends, patterns, and areas for improvement.

For instance, if data analysis reveals that a particular type of claim is frequently denied, the facility can investigate the underlying causes and take corrective action. This data-driven approach supports better decision-making and helps facilities optimize their revenue cycles.

Enhancing Patient Experience and Satisfaction

While the primary focus of Med A audits is on financial and operational efficiency, they also have a positive impact on patient experience and satisfaction. By ensuring accurate billing and reducing claim denials, audits help to minimize the financial stress on patients and their families.

Moreover, efficient operations and accurate documentation contribute to higher quality care, which directly impacts patient satisfaction. When facilities are running smoothly, staff can focus more on providing excellent care, leading to better outcomes for patients. Learn more about ensuring financial stability through accurate billing practices.

Case Studies: Success Stories of Revenue Optimization

To illustrate the impact of Med A audits on revenue optimization, let’s look at some real-world examples of facilities that have successfully implemented these audits.

- Example 1: Increasing Collections through Accurate Billing

- Example 2: Reducing Denial Rates by 20%

- Example 3: Streamlining Operations for Improved Efficiency

These case studies demonstrate the tangible benefits of Med A audits and provide valuable insights into how other facilities can achieve similar results. For more information on how Med A Audits recovered significant amounts for facilities, check out their success stories.

Example 1: Increasing Collections through Accurate Billing

A long-term care facility was struggling with low collection rates due to frequent billing errors. They decided to implement regular Med A audits to identify and correct these errors.

During the first audit, they discovered that a significant number of claims were being denied due to incorrect coding. By retraining their billing staff and implementing new procedures, they were able to reduce these errors and increase their collection rates by 30% within six months.

Example 2: Reducing Denial Rates by 20%

Another facility faced a high rate of claim denials, which was impacting their cash flow. They conducted a Med A audit to identify the root causes of these denials.

The audit revealed that many claims were being denied due to insufficient documentation. The facility implemented a comprehensive training program for their staff, focusing on accurate and thorough documentation. As a result, their denial rates dropped by 20%, leading to a more stable cash flow.

Example 3: Streamlining Operations for Improved Efficiency

A third facility used Med A audits to streamline their overall operations. The audits identified several inefficiencies in their billing and administrative processes.

By addressing these inefficiencies, the facility was able to reduce administrative costs and improve their overall operational efficiency. This not only optimized their revenue cycle but also allowed them to provide better care to their patients.

Summing Up: The Impact of Med A Audits on Revenue Optimization

Med A audits are a powerful tool for long-term care facilities looking to optimize their revenue cycles. By identifying and correcting errors, ensuring compliance with Medicare regulations, and improving operational efficiency, these audits can significantly enhance a facility’s financial health.

In addition to the financial benefits, Med A audits also contribute to better patient care and satisfaction. By streamlining processes and reducing administrative burdens, facilities can focus more on providing high-quality care to their patients.

Key Takeaways from Implementing Med A Audits

Implementing Med A audits can lead to significant improvements in revenue cycle management for long-term care facilities.

- Increased collections through accurate billing

- Reduced claim denial rates

- Improved compliance with Medicare regulations

- Enhanced operational efficiency

- Better patient experience and satisfaction

Long-Term Financial and Operational Benefits

The long-term benefits of Med A audits are clear. By optimizing revenue cycles and improving operational efficiency, long-term care facilities can achieve greater financial stability and provide better care to their patients. Regular audits ensure that facilities stay compliant with regulations and continue to improve their processes over time. For more information on this topic, you can explore what is revenue cycle management.

Ultimately, Med A audits are an investment in the future of a facility, leading to sustained financial health and operational excellence.

Frequently Asked Questions

What is Med A Audit and how does it work?

Med A audits are thorough examinations of Medicare Part A claims and billing practices. These audits identify errors, inefficiencies, and non-compliance with Medicare regulations. By addressing these issues, facilities can optimize their revenue cycles and improve overall financial health.

Can Med A Audits help reduce claim denials?

Yes, Med A audits can significantly reduce claim denials by identifying and correcting errors before claims are submitted. This proactive approach ensures that claims are accurate and complete, minimizing the risk of denials and delays in reimbursement.

How often should long-term care facilities conduct these audits?

It is recommended that long-term care facilities conduct Med A audits regularly, at least once a year. However, more frequent audits may be necessary if the facility is experiencing a high rate of claim denials or other billing issues.